Enter your shipment number.

Market Report - 1/2026

These informative and comprehensive documents highlight critical supply chain news and events, with information sourced from the industry’s leading sources.

OIA Global produces a comprehensive market report each month!

These informative documents highlight important supply chain news and events using information from the industry’s leading journalistic sources. All previous market reports can be found here.

Content Sections

- Market Trends

- Mergers & Acquisitions

- Infrastructure

- Laws & Legislation

- Sustainability

- Transport Technology

Market Trends

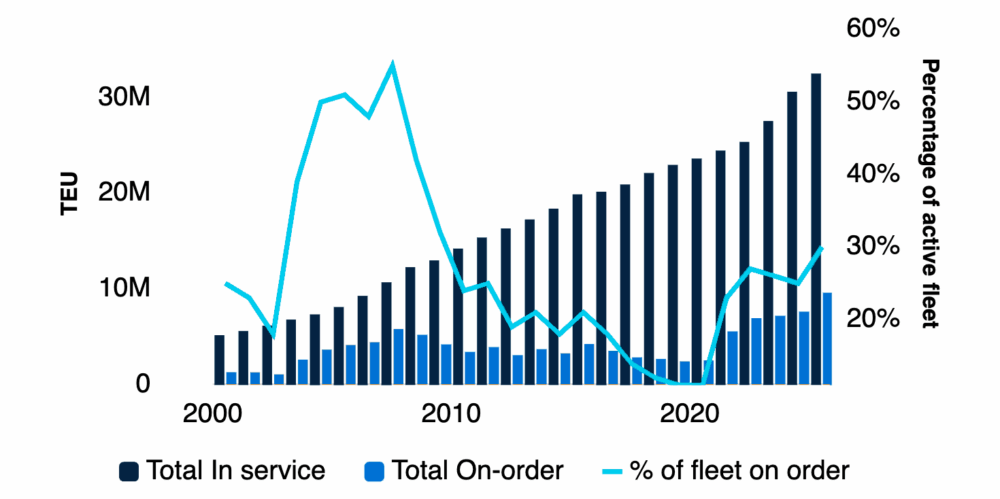

Majority of Ordered Vessels are 10,000+ TEUs

Some 1.48M TEUs of tonnage will be delivered to shipowners in 2026, a 17.7% decrease from what was received in 2025.

New vessel orders in the dry bulk shipping sector have diminished significantly, with bulker newbuilding contracting capacity falling 54% year-over-year (YoY) to 25M deadweight tons between January and November 2025.

Source: US Census Bureau via Bloomberg.

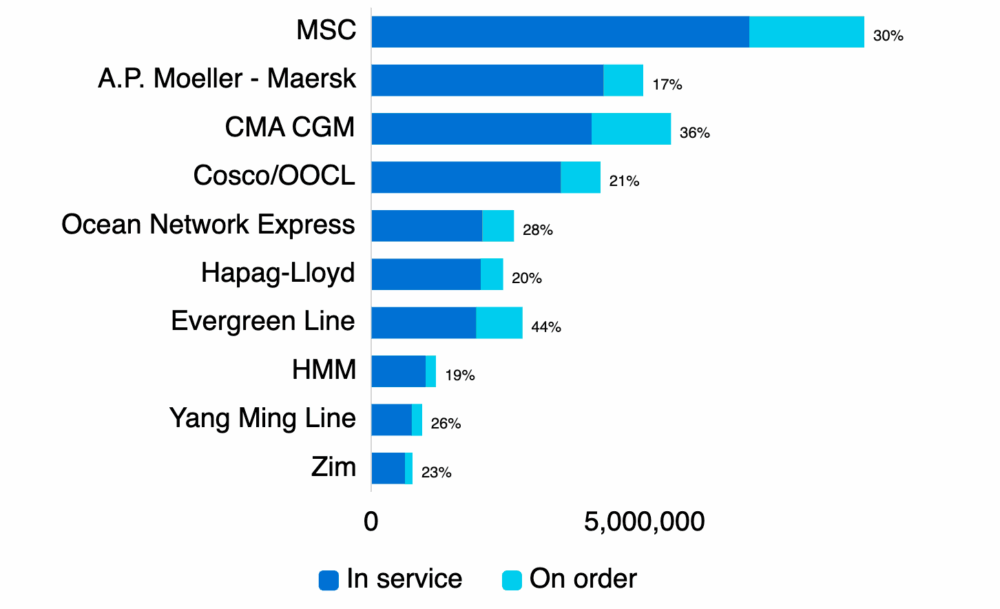

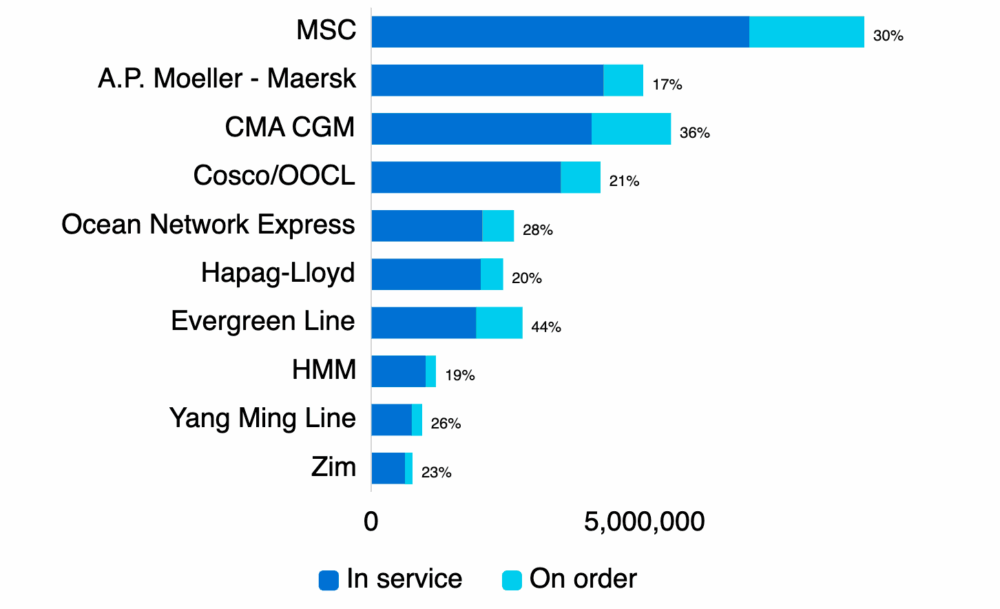

Container Ship Capacity by Carrier

Net Tonnage Displacement During H2 ‘25

A cascading effect occurred during the second half of 2025 as vessel capacity once absorbed by primary trade lanes, particularly major Asia–Europe routes, spilled into secondary trade lanes.

Source: Sea-Intelligence, Port Technology.

The Premier Alliance—ONE, Yang Ming, and HMM—is trying to improve poor schedule reliablity by shifting to a concentration of port calls at key hubs.

“New service updates will see the alliance call at more ports directly, so it looks more like a hub and spoke network without actually being it. They are looking to bridge the gap to service level improvements because schedule reliability can’t get any worse than now.”

– Peter Sand, Chief Analyst at Xeneta

U.S. Customs & Border Protection (CBP) has collected >$1B in duty revenue from over 246M low-cost shipments since phasing out the de minimis exemption.

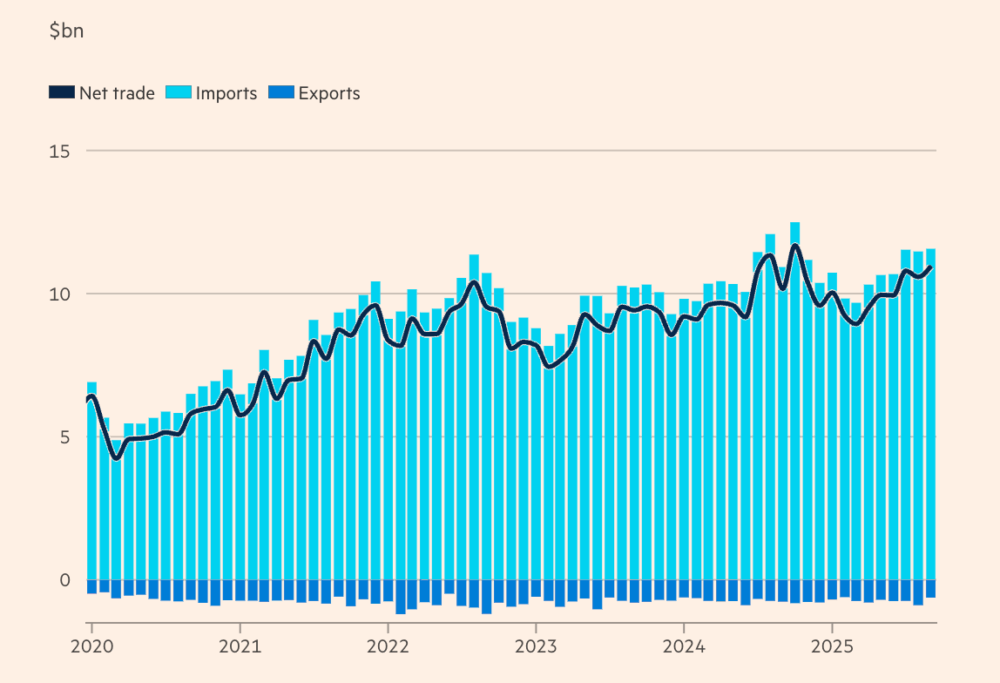

Increased tariff revenues imposed by the Trump Administration have not offset the gap between what the U.S. imports and what it sells overseas. The U.S. trade deficit has fallen significantly, and higher tariffs are certainly raising money, but they still account for just a fraction of the federal government’s total revenue.

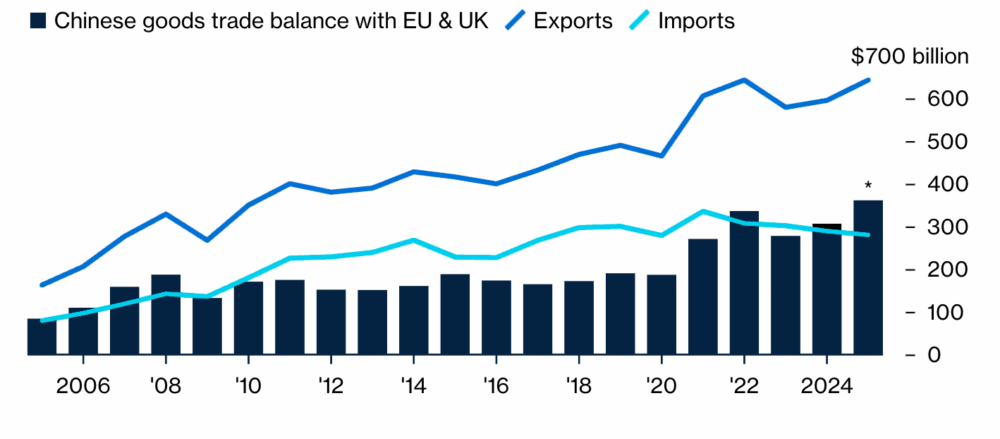

China’s trade surplus exceeded $1T for the first time. Exports rose 5.9% year-over-year (YoY) despite a plunge in Transpacific shipments to the U.S. The huge surplus underscores China’s struggle to rebalance its economy away from dependence on foreign demand, with net exports accounting for almost a third of economic growth this year.

Two simultaneous trends are reshaping the global shipping landscape:

- Surging Chinese exports to emerging markets and non-traditional trade partners

- Collapsing Transpacific volumes to the U.S.

Source: China’s General Administration of Customs, Bloomberg. Note: 2025 data is a projection based on growth rate through November.

China’s import/export surplus with Europe continued to climb as the value of China’s exports to the EU is now more than double its imports.

China is Mexico’s Second-Biggest Supplier

Mexico’s government approved new tariffs on a range of key Asian countries, including China, India, South Korea, Thailand, and Indonesia, with the changes set to take effect on January 1st, 2026.

Mexico’s imports from China have grown >75% since 2020.

Mergers & Acquisitions

Union Pacific, Norfolk Southern Merger Progresses

Both companies recently filed a 7,000-page application with the U.S. federal government’s key regulatory agency, the Surface Transportation Board (STB).

- The combined entity would create a network with 53,000+ miles of track across 43 states, connecting >100 ports.

- Roughly 75% of the projected traffic growth will come from converting truckload business to rail, with the balance diverted from competing railroads.

Currently, shipments moving across the country must be handed off between different railroad companies, creating delays and inefficiencies. A combined system would create 10,000+ new single-line service lanes, eliminating an estimated 2,400 rail car and container handlings and 60,000 car-miles each day, which could dramatically improve the speed and reliability of transcontinental freight movements.

- DP World is consolidating its Marine Services brands into a single entity. The three businesses will now operate as Shipping Solutions (formerly Unifeeder), Multimodal Solutions (formerly P&O Ferrymasters) and Maritime Solutions (formerly P&O Maritime Logistics).

- Both large and small shippers can bid for direct access to the U.S Postal Service (USPS) agency’s last-mile delivery infrastructure starting in early 2026. Winners will gain access to the agency’s delivery destination units (DDUs), which are the last stop in its network before packages reach their final address. There are >18,000 DDUs nationwide.

Infrastructure

China, Kyrgyzstan, & Uzbekistan

China, Kyrgyzstan, and Uzbekistan signed a $4.7B joint venture to build 486km of railway connecting the three countries.

- The new rail lines will create freight transit routes between China and Europe with a capacity of up to 12M tons per year.

- Seven new China/Europe routes were recently added, bringing total train movements to >1000 per year.

Colombia

Colombia’s National Infrastructure Agency is prioritizing several key corridors as part of the country’s rail revival program:

- Caribbean – Pacific Interoceanic Line

- La Caro – Central Corridor

- Buenaventura – Palmira

- Yumbo – Caimalito

- Villavicencio – Puerto Gaitán

South Africa

Transnet SOC Ltd. will expand its main terminal at South Africa’s top container hub in Durban.

- Pier 2 handles +/- 70% of Durban port’s total throughput and >40% of South Africa’s container volumes.

- New technology is expected to increase Pier 2’s capacity by 40%, reaching 2.8M twenty-foot equivalent units.

- New equipment will improve gross crane moves per hour from 18 to 28.

Brazil

The International Container Terminal Services, Inc. (ICTSI) Rio Brazil Terminal at the Port of Rio de Janeiro, will receive a R$948m (USD $174.5m) private investment to expand and modernize, increasing annual capacity from 440,000 to 750,000 TEUs.

Laws & Legislation

Starting Feb. 6, 2026, U.S. Customs and Border Protection (CBP) will issue all refunds electronically via Automated Clearing House (ACH), as announced in the Electronic Refunds Interim Final Rule published in the Federal Register. Refunds will only be issued electronically; checks will no longer be mailed, and importers without a proper ACH Refund Account will not be able to receive their refunds.

The ACE Portal is a centralized platform that connects the trade community with CBP and partner government agencies, providing real-time access to trade transactions and data. The enhanced ACE portal enables secure electronic refunds, faster payments, fewer errors, and creates a simplified process for importers, brokers, and refund recipients.

EU Changes Small Parcel Rules, Starting July 1st, 2026

The European Council will apply a fixed customs duty of €3 on small parcels valued at less than €150 entering the EU, starting July 1st, 2026.

- This encompasses about 93% of all e-commerce flows into the EU.

- The duty would apply per product type, based on six-digit tariff codes.

This means 10 pairs of socks of the same type would incur a 3-euro charge, but five pairs of socks made from wool and five from cotton would count as two item types and incur a 6-euro charge.

The new Union Customs Code is significant, particularly for e-commerce operators:

- Abolishes the 150-euro low-value consignment exemption

- Introduces simplified tariff treatment

- Extends marketplace liability with the “deemed importer” concept

- Introduces the use of the IOSS to settle customs duties with the applicable import value-added tax.

- Introduces customs handling fees

The Group of Seven (G7) countries and the European Union (EU) may replace the preexisting price cap on Russian oil exports with a full maritime services ban.

- Spot-market Russian LNG will be banned from the EU once new regulations take effect in early 2026, while pipeline gas imports will be phased out by September 30th, 2027.

The Federal Maritime Commission (FMC) is considering formal countermeasures—cargo restrictions, per-voyage fines, etc.—against shipping entities linked to Spain. This comes after a one-year investigation into Spain’s refusal to dock U.S. vessels in 2024. The FMC is now soliciting public feedback on specific remedial actions.

The United Nations (UN) General Assembly adopted a measure on negotiable cargo documents that will enable goods to be bought, sold, or used as collateral while still in transit. Negotiable cargo documents would serve as a title representing goods in transit across all modes of transport, which could enhance flexibility in trade, bridge the trade finance gap, and support increased digitization throughout global trade.

- Unlike ocean bills of lading (BoL), transport documents issued by rail, road, and air carriers—often known as consignment notes, air waybills, etc.—are not used as documents of title and cannot be transferred to another party during transport. In essence, this means cargo cannot be sold or transferred between parties while it is in transit.

Sustainability

ZEMBA’s Second Tender

Hapag-Lloyd and North Sea Container Lines (NCL) were awarded the second tender for low-emissions container shipping from the Zero Emission Maritime Buyers Alliance (ZEMBA), a group that includes major brands like Amazon, Patagonia, Nike, and others. The award will be split between two new in-development fuel types, e-methanol and e-ammonia:

- Hapag-Lloyd will deploy e-methanol on its large containerships for the trans-oceanic lane, while regional feeder company

- North Sea Container Line will use its new vessel Yara Eyde, the world’s first ammonia-powered containership, to fulfill the northern European trade lane.

- Starting Jan. 1st, 2026, the EU’s Emissions Trading System (ETS) requires shipping lines to account for 100% of carbon emissions, up from 70% in 2025, as part of its phased rollout. In response, carriers are implementing significant surcharges on trade lanes throughout the EU.

- The European Commission plans to force electrification of the rental and company car markets by 2030, installing a quota on large businesses to buy mostly electric vehicles (EVs).

- Some have criticized this move as “a backdoor ban” on petrol cars since 6/10 cars sold in Europe are to corporate fleets. For some carmakers, this segment accounts for as much as half of their annual sales.

Mercedes-Benz, Volvo, and Kenworth all expanded their electric truck offerings to meet growing fleet demand for medium- and heavy-duty electric trucks.

- Kenworth launched its first conventional medium-duty battery-electric trucks—the T280E, T380E, and T480E—extending its zero-emission lineup for Class 6-8 applications.

- Mercedes-Benz Trucks has begun series production of the second-generation eActros 400 to complement the eActros 600. The new models offer two battery packs, two cab options, and can be configured as tractor units or flatbed chassis to meet the needs of long-distance and distribution transport.

- Volvo Trucks is launching a new 15.4-short-ton version of its FL Electric medium-duty truck, designed specifically for agile inner-city transportation with its compact dimensions and zero tailpipe emissions.

Transport Technology

Chinese authorities are starting to penalize foreign vessels for operating SpaceX’s Starlink satellite service within its territorial waters.

Many international ships have adopted Starlink due to its superior internet speeds as compared to traditional maritime satellite systems, using it for navigation support, crew welfare, and operational communications.

Maritime operators now face a stark choice: switch to approved alternatives, like China’s Beidou navigation system, or local cellular networks when approaching Chinese waters, or risk substantial fines, equipment confiscation, potential vessel detention, and costly operational delays.

The Federal Motor Carrier Safety Administration (FMCSA) announced a complete overhaul of the vetting process for Electronic Logging Devices (ELDs) that track truckers’ hours of service. The changes will help ensure non-compliant devices are blocked before they ever reach FMCSA’s Registered ELD list.

- Some have been calling for the U.S. to adopt a system where approved third parties verify ELD compliance, like the Canadian system, but the FMCSA stopped short of this.

AI Systems Detect & Report Lost Containers

Following development and testing in simulation environments, Eyesea and EVI Safety Technologies are ready to test an artificial intelligence system for detecting and reporting lost containers aboard operational vessels.

- The system leverages computer vision and machine learning, using onboard deck and bridge cameras to automatically identify and count containers either falling from a ship or observed adrift.

- Once detected, incident data can be immediately transmitted to registered vessel owners, flag states, or coastal authorities.

- The Eyesea–EVI system aligns with the International Maritime Organization’s (IMO) upcoming mandatory reporting requirements by producing precise, geo-tagged imagery and structured incident data.