Enter your shipment number.

De Minimus Elimination & OIA’s Omnichannel Solutions

U.S.-based logistics providers like OIA are well-positioned to help international retailers nearshore amidst the elimination of de minimis.

8 August 2025

What is De Minimis?

The de minimis rule allowed goods valued at $800 or less to enter the United States duty-free and with minimal customs oversight. The rule was originally intended to streamline low-risk shipments, but as business-to-consumer (B2C) E-commerce exploded in popularity, de minimus became an increasingly contentious trade issue.

- The volume of de minimis shipments entering the U.S. surged to 1.36b shipments in 2024, up from just 134m shipments in 2015.

Companies typically leverage de minimis for direct-to-consumer air cargo parcels because it limits logistics costs, with many overseas sellers bypassing traditional retail channels and regulatory scrutiny. U.S. customs officials say that criminal organizations take advantage of the system to smuggle dangerous and counterfeit goods into the country and have been working to improve their ability to stop contraband via such de minimus packages.

Recent Changes

The new policy will force importers—originating from all countries—to pay the full duties and taxes on all imported shipments valued at $800 or less, regardless of value. The changes take effect on August 29th, 2025, and commercial use of de minimis will be completely repealed by July 1st, 2027.

- Executive Order: Suspending Duty-Free De Minimis Treatment for All Countries

- Fact Sheet: Suspending the De Minimus Exemption for Commercial Ships Globally

Now, low-cost imports will be subject to all applicable duties, including the various reciprocal tariffs that the Trump administration has applied to 70+ different countries.

Nearshoring

Nearshoring involves transferring a business operation to a nearby country, either the destination country or one that shares a border with the target country.

With the elimination of de minimus, near-shoring products to the U.S. will be an extremely beneficial strategy for all non-U.S. based retailers. U.S.-based logistics providers like OIA Global are well positioned to help companies that need to ship bulk inventory and store it in domestic warehouses for fulfillment.

Plus, OIA Global’s contract logistics segment is directly integrated with its transportation management segment, which enables omni-channel shipping options for small parcels. When combined, OIA’s service offerings for Contract Logistics and 3PL can create a true omni-channel experience, allowing shippers to avoid working with any U.S. based retailers. OIA’s network connectivity includes 60+ sales channels and 50+ final-mile shipping options, for both domestic and international shipments.

International Postage Rules

Notably, there is an exception for imported goods sent through the international postal network. The executive order requires air carriers and other transportation providers to collect and remit duties to CBP for shipments moved via the international postal system since the U.S. Postal Service can’t process entries through CBP’s automated system.

Postal packages will be assessed duties based on one of two methodologies:

- Ad valorem: Duties assess the value of each package equal to the tariffs imposed under the International Emergency Economic Powers Act (IEEPA). The applied tariff is based on the product’s country of origin (COO).

- Specific Duty: Duties ranging from $80-$200 per item, depending on the effective IEEPA tariff rate for the product’s COO. Note: this methodology will be available for six months, after which applicable shipments must comply with the ad valorem duty.

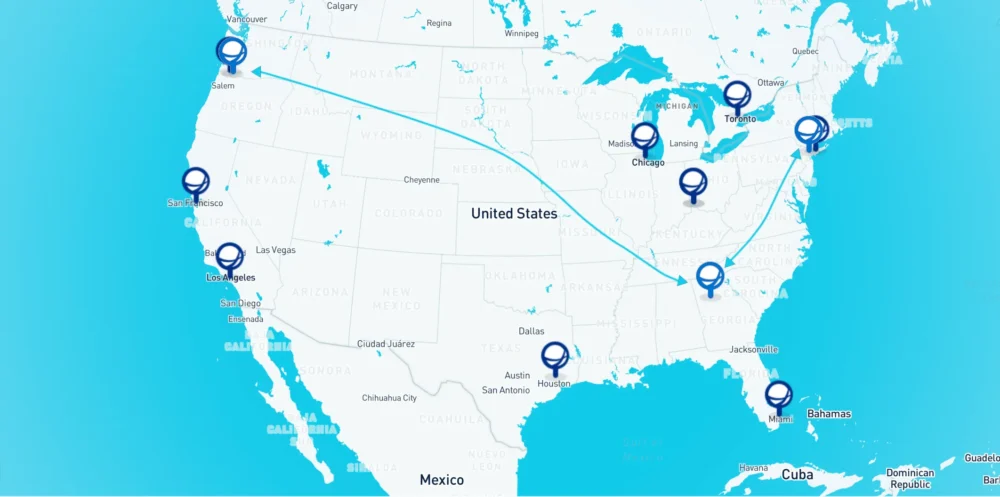

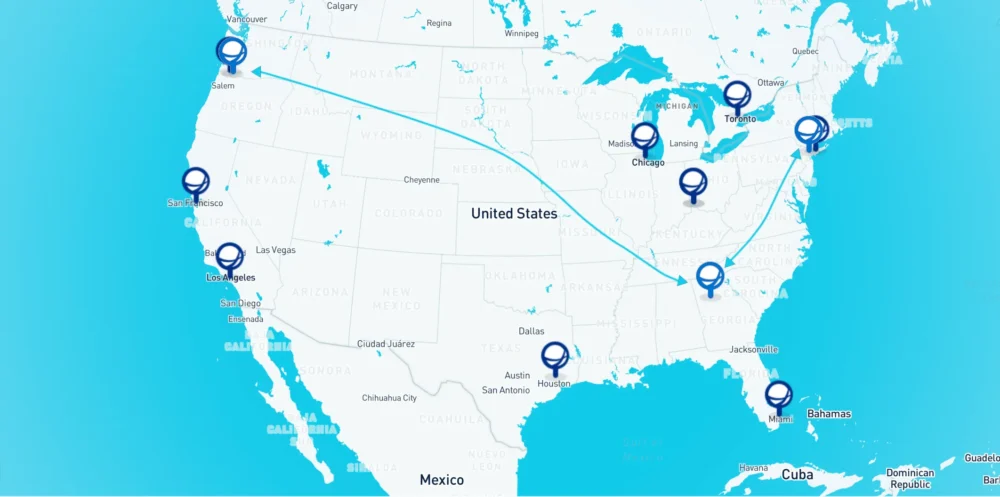

OIA’s Warehousing Hubs (USA)

To support nearshoring efforts and ensure seamless fulfillment, OIA Global operates warehousing hubs in several key regions:

Illustration of U.S. logistics and supply chain network highlighting major distribution hubs and transportation routes across the country.

There were significant delays in the import process for many E-commerce parcels when similar changes were made in the past. Shipments piled up at U.S. entry ports and post offices, and the same is expected to happen again.

Nearshoring to the U.S. allows shippers to avoid many of these concerns because transferring inventory at wholesale value—rather than the retail value since the goods are not pre-sold—often saves costs related to duties and taxes.